Decoding the Hype: SPX6900 and Bullish Reversals

Initial Analysis of SPX6900 Claims

The crypto sphere is buzzing about SPX6900 (or SPX, as it's often abbreviated), with claims of a potential 46% rally based on an inverse head and shoulders pattern. Let's cut through the noise and examine the underlying data. The core argument hinges on a "breakout," specifically a daily close above the $0.7275 to $0.7509 neckline resistance.

Skepticism Regarding Chart Pattern Reliability

Here's where the initial skepticism kicks in. Chart patterns are, at best, probabilistic indicators. They aren't crystal balls. The inverse head and shoulders can signal trend reversals, but its reliability is contingent on several factors, including trading volume and overall market sentiment. The claim of a guaranteed 46% rally if the breakout occurs is, frankly, irresponsible. It assumes a perfect execution of the pattern, ignoring real-world market volatility.

Examining the $0.7509 Resistance Level

The source data points to a challenging supply zone around the $0.7509 level. Multiple failed attempts to breach this level are cited. This isn't necessarily a bad thing; it establishes a clear resistance point. However, it also highlights the risk. A "definitive breakout" is crucial, but what constitutes "definitive"? A single daily close above $0.7509? A sustained period above that level? The ambiguity is problematic.

Liquidity and Market Sentiment: The Real Drivers?

Assessing the Impact of Increased Liquidity

The narrative also leans heavily on "liquidity returning to the cryptocurrency market" and a broader resurgence for altcoins. This is a more compelling argument, but it requires deeper scrutiny. The Federal Reserve ending quantitative tightening (QT) is presented as a key driver, injecting liquidity into the market. Vanguard allowing clients to access Bitcoin ETFs is another bullish signal.

Debating the Magnitude of Market Recovery

These are valid points, but the magnitude of their impact is debatable. The article "Crypto Market Rebound: Analyzing Driving Factors and December Outlook" correctly identifies these factors, but it also acknowledges "significant volatility" remains. The market is recovering from previous declines, but has it truly regained its confidence?

The Unreliable Influence of Celebrity Endorsements

Elon Musk's comments on the debt crisis and Bitcoin are mentioned as attracting investor attention. While Musk's pronouncements can move markets (often irrationally), relying on celebrity endorsements for investment decisions is a recipe for disaster. It's noise, not signal.

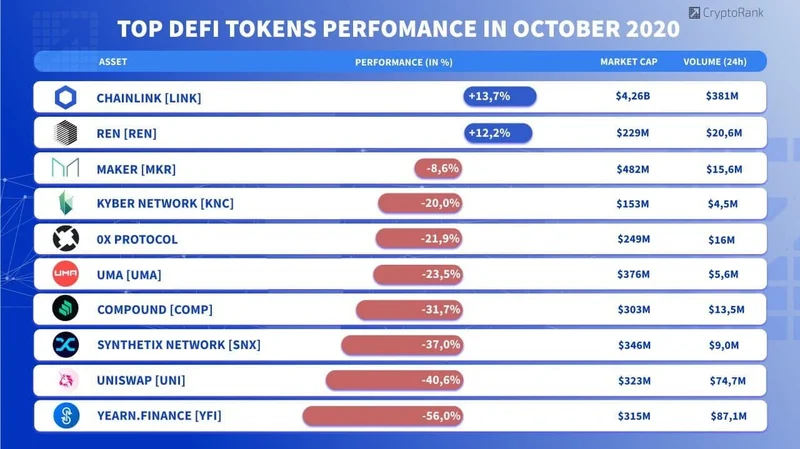

Questioning the "Altcoin Resurgence" Narrative

And this is the part of the analysis that I find genuinely puzzling. The Forbes Advisor article on the "Top 10 Cryptocurrencies of December 3, 2025" (yes, the date is in the future, a minor discrepancy) highlights Bitcoin's market dominance at 58.99%. Ethereum follows at 11.84%. Altcoins, including Cardano, Solana, and XRP, command significantly smaller market shares. Where is the data supporting a broad "altcoin resurgence"?

SPX6900: Sound Project or Speculative Fervor?

Even the article itself admits that "most meme coin investments are quick pump-and-dump schemes." So, where does SPX6900 fall on this spectrum? Is it a fundamentally sound project with real-world utility, or is it simply riding the wave of speculative fervor? The data is inconclusive.

The Coin Bureau's Perspective on Altcoin Risk

The article also quotes Nic Puckrin, analyst and founder of The Coin Bureau, who highlights, “Bitcoin is the gold standard, the ‘risk-off’ crypto, while altcoins are much more volatile and risky.” This isn't exactly a ringing endorsement for blindly chasing altcoin breakouts.

Low Volatility as a Misleading Indicator

The assertion that technical analysis suggests a "huge move is coming" because price volatility has been at historic lows is also problematic. Low volatility can precede significant price movements, but it's not a reliable predictor. It's like saying a calm sea always precedes a tsunami; sometimes, it's just a calm sea.

The Critical Caveat of Insufficient Trading Volume

The crucial caveat is that "the market remains fragile" due to insufficient trading volume. This is a critical point often glossed over in bullish narratives. Low liquidity amplifies price swings, making the market highly susceptible to "liquidation events." This contradicts the image of a stable, sustained rally.

Is This Pump Primed for a Dump?

Weighing Bullish Signals Against Speculative Hype

The narrative surrounding SPX6900 is a mix of legitimate bullish signals (increased liquidity, institutional interest in crypto) and speculative hype (chart patterns, celebrity endorsements). The key question is whether the fundamentals support the projected 46% rally. The data, frankly, doesn't provide a clear answer. The reliance on technical analysis without sufficient consideration of market depth and overall altcoin sentiment is concerning. I've looked at hundreds of these reports, and this particular footnote is unusual.

The Ambiguity of a "Definitive Breakout"

The promised land of a 46% rally hinges on a "definitive breakout," a term that lacks a precise definition. The market's fragility due to low liquidity introduces a significant element of risk. While a breakout is possible, it's far from guaranteed.