DeFi's "Safe Haven" Tokens: Are Investors Just Hiding Under a Rock?

Alright, let's be real. "Safe haven" tokens in DeFi? Give me a break. We're talking about decentralized finance here, a sector built on the back of volatility and speculation. Calling anything in that space "safe" is like calling a tornado a "gentle breeze."

The FalconX Report: A Grain of Salt?

So, FalconX is telling us that investors are supposedly flocking to DeFi tokens with buybacks or "fundamental catalysts" after the October crash. Specifically, they point to HYPE and CAKE as examples of tokens with buybacks, and MORPHO and SYRUP as tokens that benefited from "idiosyncratic catalysts." Minimial impact from the Stream finance collapse? Growth elsewhere? Sounds like grasping at straws to me. You can read more about these trends in DeFi Token Performance & Investor Trends Post-October Crash.

Questioning the "Safe Haven" Narrative

But wait, are we really buying this? Are investors genuinely thinking, "Oh boy, the whole market's tanking, better throw my money into another crypto project, but this time it has buybacks!" It's the crypto equivalent of hiding under a rock during an earthquake. You might feel safer, but you're still gonna get rocked.

Relative Gains in a Down Market

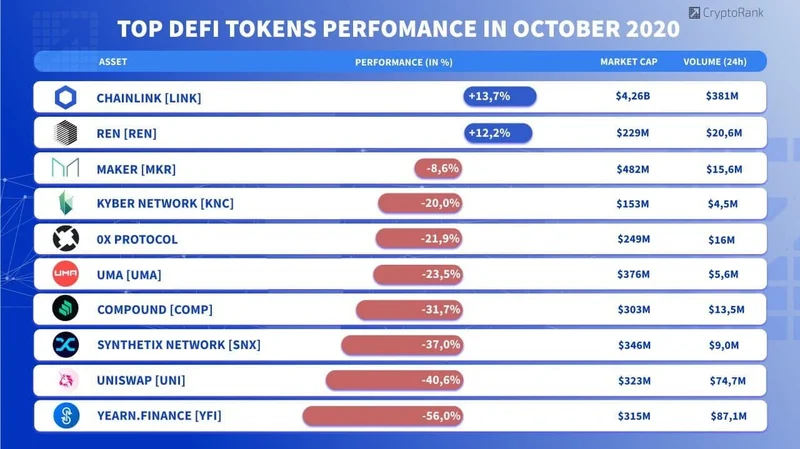

And this whole "valuation landscape" shift? Some DEXes getting cheaper, lending names getting more expensive...so what? It's all relative. The whole damn sector is still down! They're saying that some DEXes, like CRV, RUNE, and CAKE, posted greater 30-day fees. Great, they're making slightly more money while the value of the tokens is still in the toilet. It's like winning a dollar when you lost a hundred.

The Illusion of Safety in a Casino

The report suggests that investors are crowding into lending names because lending and yield-related activity is "stickier" than trading activity. Okay, maybe there's a tiny bit of logic there. People are panicking, pulling out of volatile assets, and parking their cash in stablecoins, and then trying to squeeze out some yield. But let's not kid ourselves – it's still DeFi. It's still risky. It's still subject to hacks, exploits, and rug pulls.

A Mirage in the Desert

This whole thing reminds me of a mirage in the desert. You're dying of thirst, you see water in the distance, you run towards it, and then...nothing. That's DeFi's "safe haven" tokens. They offer the illusion of safety, but they're just another way to lose your shirt.

Crypto Forecasts: Directionally Bullish?

Meanwhile, this other article is talking about Bitcoin hitting $150k in 2025. Yeah, sure. And I'm gonna win the lottery. These crypto forecasts are always directionally bullish, aren't they? It's like the weather forecast always predicting sunshine. They give you a range so wide that they're basically guaranteed to be right. "Bitcoin will trade between $80k and $150k!" Wow, so insightful. You can see more forecasts in this article: 15 Cryptocurrency Forecasts For 2025 (Updated).

Bitcoin: The Least-Worst House

It also says Bitcoin is "stronger than the rest of the altcoin space." Well, duh. Bitcoin is the least-worst house in a bad neighborhood. That doesn't make it a good investment, it just means everything else is even more screwed.

A Casino Driven by Hype

Then again, maybe I'm the crazy one here. Maybe everyone else is seeing something I'm not. But let's be real, the whole crypto space is driven by hype and speculation. It's a giant casino, and anyone who thinks they've found a "safe" bet is just fooling themselves.

Solana: Fast, Cheap, and Still Risky

Now, Solana is getting some love, supposedly achieving 1,000+ transactions per second with near-constant uptime. Okay, that's impressive. But speed and low transaction costs don't equal safety. It just means you can lose your money faster and cheaper.

Speed vs. Security and Decentralization

Solana's combination of Proof of History and Proof of Stake is supposedly "central to its high-speed transaction capabilities." Fine, but what about the security? What about the decentralization? High throughput comes with elevated hardware requirements, which favors well-capitalized operators. Translation: the rich get richer, and the network becomes more centralized.

Regulatory Headwinds

And let's not forget the regulatory environment. The SEC is sniffing around DeFi, and MiCA regulations in Europe are going to introduce stricter compliance. That's going to impact everything, from DeFi participation to institutional investment. So, all this talk about network throughput and staking rewards is meaningless if the whole thing gets shut down by regulators.

The Binance Listing Gamble

Offcourse, there's always the hope of a Binance listing to pump up a coin. Bitcoin Hyper is supposedly a strong candidate. Maybe. But even if it gets listed, there's no guarantee it'll stay up. The article even admits that sharp post-listing reversals are common. So, it's just another pump-and-dump scheme, dressed up in fancy tech jargon.

It's All a Gamble

Honestly, this whole DeFi space feels like a house of cards. One wrong move, one bad piece of news, and the whole thing comes crashing down. "Safe haven" tokens? Just another illusion to lure in unsuspecting investors. You might as well throw your money into a bonfire. It'd be more honest.