DeFi's Phoenix Moment: Why This Dip Is a Launchpad for the Future

Market Overview and the Phoenix Analogy

Okay, friends, let's talk crypto. I know, I know—the market's been a bit of a rollercoaster lately. We’re seeing headlines about DeFi tokens taking a hit, Bitcoin ETFs experiencing outflows... It's enough to make anyone a little queasy, right? But here's the thing: I'm seeing something else entirely. I'm seeing a phoenix moment.

You know, the mythical bird that rises from the ashes? That's DeFi right now. We've got reports saying only a tiny fraction of DeFi tokens are positive this year, and that's true on the surface. But beneath the noise, I see innovation, resilience, and a whole lot of potential.

Institutional Adoption and Infrastructure Development

Think about it: Even with the market turbulence, BlackRock is registering an iShares Staked Ethereum Trust. That's BlackRock, people! They're not just dipping their toes in; they're diving headfirst into yield-generating ether ETFs. This isn't some fly-by-night operation; it's a sign that institutional investors are taking DeFi seriously—very seriously. And Mastercard? They're expanding their Crypto Credential system to self-custody wallets, using Polygon's blockchain for KYC-verified identities. This is exactly the kind of infrastructure we need to bring DeFi to the masses. It's about making crypto accessible, secure, and, dare I say, user-friendly.

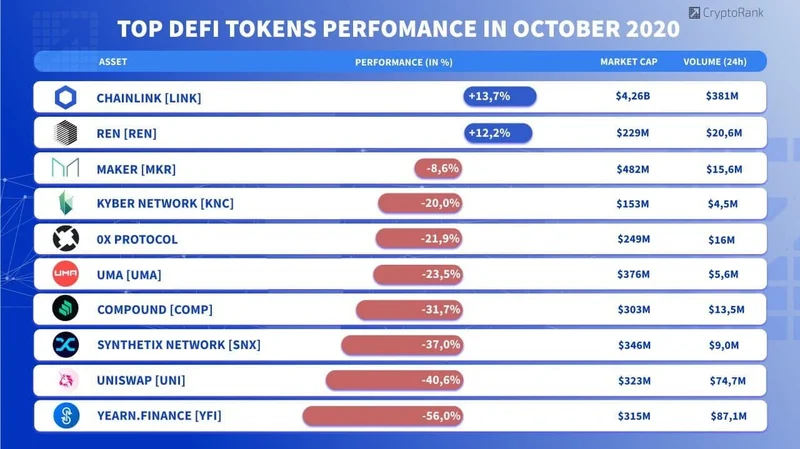

Opportunity in Downturn and Flight to Quality

Now, I know what you're thinking: "Aris, that's great, but what about all the red numbers?" And yeah, the numbers are red right now. We're seeing significant downtrends, and some DeFi subsectors are looking a little pricey. But here's where the opportunity lies. As Warren Buffett famously said, "Be fearful when others are greedy, and greedy when others are fearful." Could this be that moment? I honestly believe it is.

We're seeing investors flock to "safer" DeFi names, which tells me people are still engaged; they're just getting smarter about where they put their money. They're looking for value, for stability, for projects with real-world utility. And that's exactly what DeFi needs: a flight to quality.

Bitcoin Adoption and Web3 Security

And then there's El Salvador. Love them or hate them, they're doubling down on Bitcoin, increasing their holdings to nearly 7,500 BTC. That’s a serious commitment, and it signals a long-term belief in the future of crypto.

But let’s zoom in on GoPlus, a company that provides security solutions for Web3. They’ve generated millions in revenue, mostly from their app. And $GPS, their token, has seen billions in trading volume. That tells me there's a real demand for security and trust in the crypto space. People are willing to pay for it, which is huge. It's like the early days of the internet when everyone realized they needed antivirus software—but for DeFi!

Long-Term Vision and DeFi's Future

It's easy to get caught up in the day-to-day price fluctuations, but we need to zoom out and look at the bigger picture. We're building a new financial system, and it's not going to be a smooth ride. There will be bumps, dips, and maybe even a few crashes along the way. But the underlying trend is clear: DeFi is here to stay, and it's only going to get bigger and better.

The Ethical Imperative: Building a Responsible Future

Now, with all this excitement, let’s pump the brakes for a moment. This isn't just about making money; it's about building a responsible and ethical financial system. We need to think about the implications of DeFi, the potential risks, and how we can mitigate them. As we build this new world, we must prioritize security, transparency, and accessibility for everyone. What good is a revolutionary technology if it only benefits a select few?

Learning from Mistakes and Building a Stronger Foundation

I saw one comment on a Reddit thread that really resonated with me. Someone wrote, "This dip is a chance to rebuild stronger, to fix the cracks in the foundation." And that's exactly right! We can use this moment to learn from our mistakes, to improve our protocols, and to create a more resilient and inclusive DeFi ecosystem.

It's a bit like the early days of the automobile. Remember when cars were unreliable, expensive, and downright dangerous? But people kept tinkering, innovating, and improving until we ended up with the vehicles we have today. DeFi is at that stage right now. It's messy, it's imperfect, but it's full of potential.

Bitcoin-Backed Capital and Regulatory Considerations

And speaking of potential, Metaplanet is unveiling a new Bitcoin-backed capital structure with a $150M perpetual preferred offering. What this means is that they are going to be able to raise money by using Bitcoin as collateral. Think of it as a Bitcoin-backed bond. It’s a game changer.

But I also think we need to ask ourselves some tough questions. How do we ensure that DeFi is accessible to everyone, regardless of their background or financial status? How do we prevent fraud and manipulation in the market? And how do we create a regulatory framework that fosters innovation without stifling growth? These are the questions we need to be asking ourselves, and we need to start answering them now.

DeFi's Not Dead, It's Leveling Up!

So, what's the real takeaway here? It's simple: Don't panic. This dip isn't the end of DeFi; it's a reset. It's an opportunity to learn, to grow, and to build a better future. The foundations are solidifying. The institutions are moving in. And the community is more passionate than ever.

This isn't just about technology; it's about people. It's about creating a financial system that is more fair, more transparent, and more accessible to everyone. And that's something worth fighting for, isn’t it? This kind of breakthrough reminds me why I got into this field in the first place. So let's roll up our sleeves, get to work, and build the future we want to see. The future is decentralized, and I, for one, am incredibly excited to be a part of it.